New ‘Young Child Tax Credit’ & Higher Income Limits Among Highlights of This Year’s California Earned Income Tax Credit

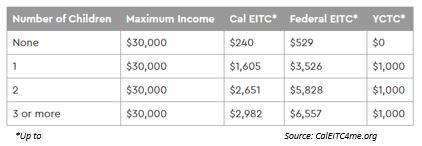

With tax season here, it’s a good time to remind working residents to file for a refund through the Californian Earned Income Tax Credit (CalEITC), an effective anti-poverty tool that puts cash back into the pockets of people who need it the most. If eligible, the upper range of the CalEITC can be between $240 and $2,982, depending on household size.

On top of the CalEITC refund, new this year is up to $1,000 more for families with at least one child under six years old. Income limits have also been raised for 2019 earnings.

“Research shows that too many people cannot cover an unexpected $400 expense,” said Assemblymember Phil Ting (D-San Francisco). “California’s strong economy enables us to give a modest income boost to working families. Whether the money is for bills, school supplies or savings, a refund can be life-changing, especially when combined with the federal EITC.”

As Chair of the Assembly Budget Committee, Ting also championed previous expansions of CalEITC during the 2017-18 and 2018-19 budget cycles. With the inclusion of workers between ages 18-24 and over age 65, plus gig economy workers, more Californians have become eligible for a refund.

For the 2018 tax season, 2.1 million Californians claimed the CalEITC tax credit, receiving nearly $400 million back. For this year’s tax season, the Franchise Tax Board expects that number to increase to 3 million with about $1 billion claimed between the CalEITC and Young Child Tax Credit. Workers must file an income tax return in order to get the refund, even if they don’t owe any taxes. Every year, California leaves $2 billion of unclaimed state and federal EITC money on the table.

CalEITC began in 2015. 29 states and the District of Columbia have adopted a state EITC program to supplement the federal EITC.

For more information or to find free tax assistance, please visit: www.CalEITC4me.org.

# # # # # #

(Sacramento) – To boost California’s legal cannabis market, Assemblymember Phil Ting (D-San Francisco) introduced AB 2456, legislation to create a model ordinance that provides guidance to cities and counties wanting to set up such retailers in their jurisdictions. A regulated marketplace is critical for patients and consumers to access safe and tested products.

(Sacramento) – To boost California’s legal cannabis market, Assemblymember Phil Ting (D-San Francisco) introduced AB 2456, legislation to create a model ordinance that provides guidance to cities and counties wanting to set up such retailers in their jurisdictions. A regulated marketplace is critical for patients and consumers to access safe and tested products.

Strong reserves in the Rainy Day Fund and Resiliency Fund ($21 billion total);

Strong reserves in the Rainy Day Fund and Resiliency Fund ($21 billion total);

(Sacramento) – After another successful legislative year, several bills authored by Assemblymember Phil Ting (D-San Francisco) will take effect on January 1, 2020. They include:

(Sacramento) – After another successful legislative year, several bills authored by Assemblymember Phil Ting (D-San Francisco) will take effect on January 1, 2020. They include: