The California Earned Income Tax Credit (CalEITC) is a cash back tax credit that puts money back into the pockets of California workers who earn up to $30,000 per year. In its first year, CalEITC boosted the income of nearly 400,000 families, who received almost $200 million back. Thanks to expansions championed by Assemblymember Phil Ting (D-San Francisco), more than 2 million people claimed the credit last year, totaling close to $400 million.

New this year is the Young Child Tax Credit (YCTC) that could add another $1,000 more in refunds for parents with at least one child younger than age 6 as of Dec. 31, 2019. In 2020, an estimated 400,000 California families are expected to benefit from the YCTC.

You may be eligible for the CalEITC if:

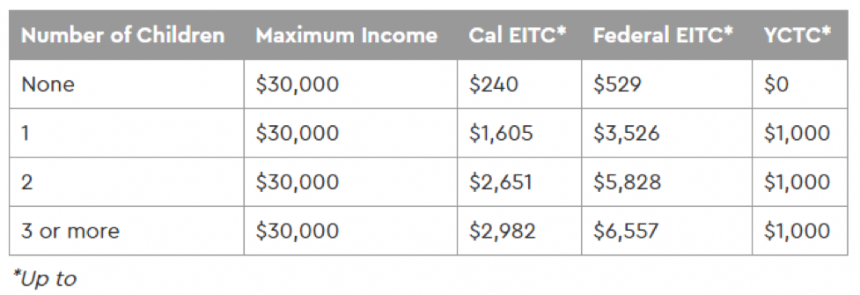

- You have earned income within certain limits (see chart below), AND

- You, your spouse, and any qualifying children each have a social security number (SSN), AND

- You do not use the “married/RDP filing separate” filing status, AND

- You lived in California for more than half the tax year, AND

- You are age 18 or older at the end of the tax year

Review the chart below to see if you may be eligible and how much you may qualify for when filing your 2019 tax return.

You can find a CalEITC calculator here.