The tax deadline is fast approaching! This year, one million more Californians may be eligible for a state refund under the California Earned Income Tax Credit (CalEITC), which was expanded again for the 2018 tax year. Assemblymember Phil Ting (D-San Francisco), Chair of the Assembly Budget Committee, championed the effort during negotiations in 2018. Research has shown that EITCs are an effective anti-poverty tool.

The tax deadline is fast approaching! This year, one million more Californians may be eligible for a state refund under the California Earned Income Tax Credit (CalEITC), which was expanded again for the 2018 tax year. Assemblymember Phil Ting (D-San Francisco), Chair of the Assembly Budget Committee, championed the effort during negotiations in 2018. Research has shown that EITCs are an effective anti-poverty tool.

CalEITC put nearly $350 million directly in the hands of 1.4 million people last year, tripling the number of households that claimed the credit when compared to the prior year. This year, the Franchise Tax Board reports 39% more people have claimed the CalEITC compared to this time last year, already receiving $180 million back.

“California’s strong economy enables us to give a modest income boost to the families that need it the most,” said Ting. “Close to half of Californians who claimed the state Earned Income Tax Credit last year are single-parent households with children, and a refund can be life-changing for them. Adding self-employed workers for the first time in the 2017 tax year, particularly those in the gig economy, was especially impactful.”

Workers must file an income tax return in order to get the refund, even if they don’t owe any taxes. Every year, California leaves $2 billion of unclaimed state and federal EITC money on the table. Help us spread the word! Numerous non-profits can connect workers with free tax preparation services. This year, taxes are due by Monday, April 15th.

New for the 2018 tax year:

- Income limit increased to $24,950 (vs $22,300 in 2017)

- Young adults aged 18-24 with no dependents now qualify

- Seniors aged 65 and up with no dependents now qualify

- Maximum refunds increased to $2,879 (vs $2,775 in 2017)

The following changes were made for the 2017 tax year, which resulted in tripling the number of households claiming CalEITC, from 350,000 households to 1.4 million:

- Income limit was $22,300 (vs $14,161 in 2016)

- Self-employed workers became eligible (and still are)

- Maximum refunds increased to $2,775 (vs $2,706)

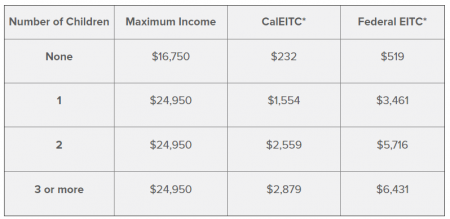

Combined with the Federal EITC, the tax refund can be significant:

* Up to Source: CalEITC4me.org

CalEITC began in 2015. 29 states and the District of Columbia have adopted a state EITC program to supplement the federal EITC. Governor Newsom proposed to double EITC funding in his budget last month, reaching workers earning up to $15 an hour and including an extra $500 credit amount for families with young children. The Legislature is expected to consider the plan as budget negotiations ramp up in the coming weeks.

For more information, please visit: www.CalEITC4me.org.