More Californians are eligible for a state tax refund under the California Earned Income Tax Credit (CalEITC), which was expanded for the 2017 tax year and beyond. Assemblymember Phil Ting (D-San Francisco), Chair of the Assembly Budget Committee, fought to expand the program through the state budget process last year. Research shows that EITCs are an effective anti-poverty tool for many struggling families.

“When working families live paycheck to paycheck, they struggle to build and focus on the future. This modest boost in income can be life-changing,” said Ting. “The previous income limits were too low, and I’m glad the Governor and my colleagues in the Legislature agreed with me that more Californians should benefit.”

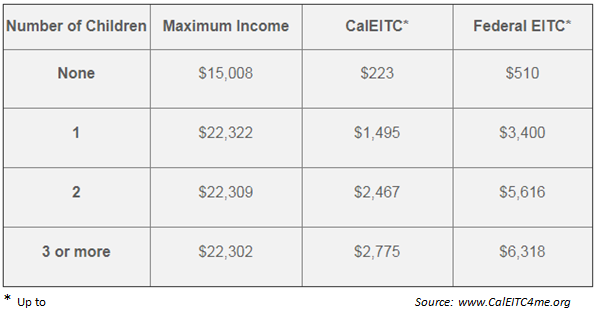

The Institute of Taxation and Economic Policy estimates more than a million additional families more could benefit under the CalEITC expansion:

- Income limit is now $22,300 (vs. $14,161 in 2016)

- Self-employed workers now eligible (before they were not)

- More minimum wage workers qualify

When combined with the Federal EITC, the tax refund can be significant:

“It’s important everyone who qualifies takes advantage of the opportunity to receive free tax assistance through the Volunteer Income Tax Assistance (VITA) program. As a CPA, I know taxes can be complicated, so the free VITA program is a great way to help people file their taxes on time and find out about refundable credits like the Earned Income Tax Credits (EITC) – where they may be eligible to receive money back to pay for basic household needs,” said Vice Chair of the California State Board of Equalization Fiona Ma, CPA.

Workers must file an income tax return in order to get the refund. Every year, California leaves $2 billion of unclaimed EITC money, both state and federal, on the table. CalEITC puts almost $200 million directly into the hands of 400,000 working Californians. Unfortunately, more than 50,000 working people filed California taxes last year and failed to claim the credit, despite being eligible for it.

Help us spread the word! Numerous non-profits, like United Way, can connect workers with free tax preparation services. This year, taxes are due by April 17.

“The Earned Income Tax Credit is the most effective anti-poverty tool in America,” said Kelly Batson, United Way Bay Area Senior Vice President, Community Impact. “United Way is proud to lead the Earn It! Keep It! Save It! coalition and support the work of nearly 3,000 volunteers at over 200 locations changing lives one tax return at a time. In addition to the tax refunds, we are saving families and individuals millions of dollars in tax preparation fees.”

At the Chinese Newcomers Service Center in San Francisco, for instance, Executive Director George Chan says nearly 400 families have claimed the state EITC, putting $54,000 back in their pockets. “We expect even more families to benefit because the tax deadline is still a month away,” he said.

Some examples of how parents at the Chinese Newcomers Service Center are benefiting from the expanded CalEITC:

- “I will be using my additional refund on summer camp for my 5-year-old daughter so that she can develop social skills and learn additional skills that parents can’t teach,” said Client A, a single father.

- “We plan to save the refund for our son’s college tuition,” said Client B, parents of a 12-year-old.

CalEITC began in 2015. California joined 24 other states and the District of Columbia in adopting a state EITC to supplement the federal EITC. For more information on the state program, please visit: www.CalEITC4me.org.